Imagine you are in the market for buying a car. You go to a car dealer, try to lowball the price of a $10k car. The dealer is not playing games so that's last price. And you insist and make an offer to the dealer: "if the prices go lower than $9k next friday, I promise to buy this car at $9k".

The offer is weird but sweet at the same time for a risk averse dealer. But there must be a catch as you are promising something. You ask the dealer to give you $100 for this deal as a premium. You act as an insurance broker for the dealer. You can continue playing this game and pocket $100 every week.

Well, obviously you shall not waste your time trying to convince a car dealer to play this game in real life. But there is a place you can play this game: options market.

Instead of promising to buy the car at $9k, you can promise to buy a stock, lets say Tesla stock at $800 (currently trading at $900). In exchange for this promise you will get $780 (today's real value) premium immediately. If the price does not go below $800 until next Friday, you will keep the premium.

Sounds too good to be true? Well, here are the details:

You are promising to buy 100 Tesla stocks (as stocks options multiplier is 100) so you'd better have $80k handy just in case. Hold on, you don't have $80k? No worries, lets change the game a little bit.

You promise to buy it at $800 (selling puts) and at the same time purchase a right to sell them (buying puts) if the price drops below $790. You still get your $780 premium but pay another person $655 netting $135. This time you will only need $1k capital. If everything goes according to the plan you get 13.5% return of investment in just one week. By repeating this game, you can get 54% ROI in a month.

Now let's say now you made enough money and really bought 100 Tesla stocks. Now you can start playing on other side to collect premiums. You can promise to sell your stocks at $990 (selling calls) and get paid a whopping $1,245 premium. You can continue teasing the potential buyers on the weekly basis like this and collect the premium. Since you have the stock in hand, we call this transaction a covered call.

Above I have described just a few option strategies as a soft welcome. There are many other strategies depending on your risk appetite or capital in hand.

Since we are targeting a stable income, here are couple of things to keep in mind while trading options:

- Trend is your friend: Bullish market trend is best suited for options trading while bear market can bring nice opportunities. You have to choose your strategy accordingly. Don't go against the trend.

- You can always end up with the stocks if you are assigned. So make sure that you only get assigned the quality stocks you would be happy to own.

- Know your greeks: Options trading platforms will provide you some greek letter parameters. Among those, delta is the most important; it is the probability of winning or losing depending on your direction.

- Selling puts/calls brings you premium in exchange for your commitment to buy or sell. Don't go naked even if a platform allows you to do so.

- Buying puts/calls costs you premium in exchange for having a right to buy/sell the stocks. Use them to limit your risk or make more by longing/shorting risk for free.

After digesting the principles above lets go over the strategies you can use:

You may wonder how much time you'd need to trade options to make a decent income. Here is what I did: Skipped the lunches during the weekdays (I was doing intermittent fasting anyway), did 40-50 minutes indoor cycling while trading on my phone. At the weekend, spent 20-30 minutes to identify risky positions by simulating my portfolio and planned the upcoming weeks in terms of expanding positions, limiting them etc.

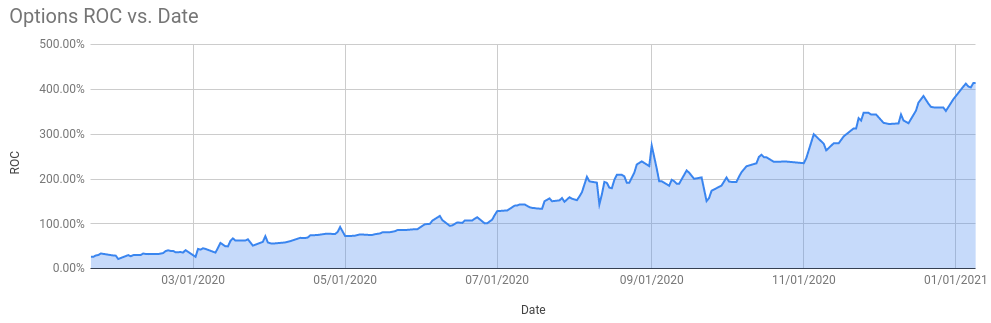

Here is a simulation of my options trading portfolio during my first year in trading options. I have simulated the market moves from -100% to +100%; it has proven to be rock solid based on the ROC (Return of capital) values as I was sticking to the principles above.

Using this simulation and the principles above helped me more than double my portfolio within 6 months and quadruple by the end of the year.

Options trading is quite specialized experience so don't try to go with your traditional broker. I'd recommend you to use Tastyworks for the best mobile experience assuming you want to multi-task during other activities such as indoor-cycling, waiting for something etc. There is also Thinkorswim which is originally created and later sold to TD Ameritrade by the same people who created Tastyworks. In my opinion Tastyworks mobile experience is much more superior to anything else you will find.

I am also working on opening my simulation to public. It will support Tastyworks and Think-or-swim. But it still needs some work. So please show some love, subscribe and share this post with your friends.

I'd appreciate if you use my Tastyworks link to join the platform as the affiliate income from that will help me keep this blog up and running.